Commercial Real Estate

Office - Retail - Land - Industrial/Warehouse

Real estate is an asset form with limited liquidity relative to other investments, it is also capital intensive (although capital may be gained through mortgage leverage) and is highly cash flow dependent. The primary cause of investment failure for real estate is that the investor goes into negative cash flow for a period of time that is not sustainable, often forcing them to resell the property at a loss or go into insolvency. A typical investment property generates cash flows to an investor in four general ways:

- net operating income (NOI)

- tax shelter offsets

- equity build-up

- capital appreciation

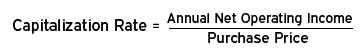

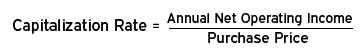

Net operating income, or NOI, is the sum of all positive cash flows from rents and other sourcesof ordinary income generated by a property, minus the sum of ongoing expenses, such as maintenance, utilities, fees, taxes, and other items of that nature (debt service is not factored into the NOI). The ratio of NOI to the asset purchase price, expressed as a percentage, is called the capitalization rate, or CAP rate, and is a common measure of the performance of an investment property.

Tax shelter offsets occur in one of three ways: depreciation (which may sometimes be accelerated), tax credits, and carryover losses which reduce tax liability charged against income from other sources. Equity build-up is the increase in the investor's equity ratio as the portion of debt service payments devoted to principal accrue over time.

Equity build-up counts as a positive cash flow from the asset where the debt service payment is made out of income from the property, rather than from independent income sources.Capital appreciation is the increase in market value of the asset over time, realized as a cash flow when the property is sold.

Capital appreciation can be very unpredictable unless it is part of a development and improvement strategy.

The amount financed by the investor's own capital, through cash or other asset transfers, is referred to as equity. The ratio of leverage to total appraised value (often referred to as "LTV", or loan to value for a conventional mortgage) is one mathematical measure of the risk an investor is taking by using leverage to finance the purchase of a property. Investors usually seek to decrease their equity requirements and increase their leverage, so that their return on investment (ROI) is maximized.

Individual properties are unique to themselves and not directly interchangeable, which presents a major challenge to an investor seeking to evaluate prices and investment opportunities

Capitalization rate (or cap rate) is the ratio between the net operating income produced by an asset and its capital cost (the original price paid to buy the asset) or alternatively its current market value. The rate is calculated in a simple fashion as follows:

For example, if a building is purchased for $1,000,000 sale price and it produces $100,000 in positive net operating income (the amount left over after fixed costs and variable costs is subtracted from gross lease income) during one year, then:

• $100,000 / $1,000,000 = 0.10 = 10%

The asset's capitalization rate is ten percent; one-tenth of the building's cost is paid by the year's net proceeds.

If the owner bought the building twenty years ago for $200,000, his cap rate is

• $100,000 / $200,000 = 0.50 = 50%.

However, the investor must take into account the opportunity cost of keeping his money tied up in this investment. By keeping this building, he is losing the opportunity of investing $1,000,000 (by selling the building at its market value and investing the proceeds). As shown above, if a building worth a million dollars brings in a net of one hundred thousand dollars a year, then the cap rate is ten percent. The current value of the investment, not the actual initial investment, should be used in the cap rate calculation. Thus, for the owner of the building who bought it twenty years ago for $200,000, the real cap rate is ten percent, not fifty percent, and he has a million dollars invested, not two hundred thousand.

Evaluate your options - contact Commercial Investment Solutions to get a valuation with one of our experts.

RELATED QUICK LINKS: What is the Right Investment, Glossary Terms

|